Managing financial transactions in an organization often requires clarity in the classification of expenses and income. In an e-invoice system, this becomes critical for accurate record-keeping and compliance with tax regulations. Two frequently encountered concepts are Disbursement and Reimbursement. This blog will clarify these concepts and explain how Treezsoft’s e-invoice system can handle these scenarios effectively.

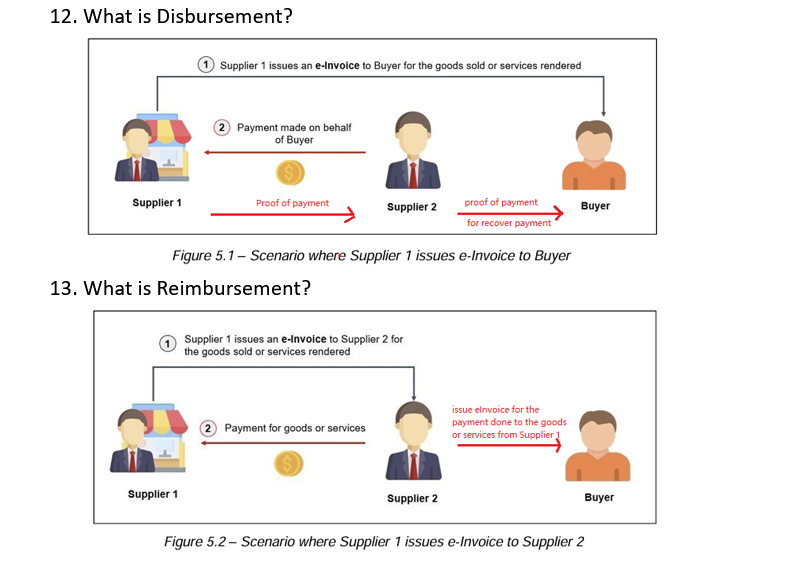

What is Disbursement?

Disbursement occurs when a party makes a payment on behalf of another and later seeks recovery of that payment. For example:

- Scenario: Supplier 1 issues an e-invoice to a buyer for goods or services rendered. However, Supplier 2 makes the payment on behalf of the buyer to Supplier 1.

- Process: Supplier 2 provides proof of payment to the buyer to recover the amount paid.

- Purpose: This allows Supplier 2 to track and recover the funds paid on behalf of the buyer.

What is Reimbursement?

Reimbursement occurs when one party compensates another for expenses incurred on its behalf. For example:

- Scenario: Supplier 1 issues an e-invoice to Supplier 2 for goods or services. Supplier 2, in turn, seeks reimbursement from the buyer for these expenses.

- Process: Supplier 2 issues an e-invoice to the buyer to recover the amount paid for goods or services.

- Purpose: This ensures that Supplier 2 is compensated for payments it made on behalf of the buyer.

Comparison Table: Disbursement vs. Reimbursement

| Aspect |

Disbursement |

Reimbursement |

| Definition |

Payment made on behalf of another party. |

Recovery of expenses incurred on behalf of another party. |

| Scenario |

Invoice is issued under the name of Buyer while Supplier 2 made the payment on behalf.

|

Invoice is issued under the name of Supplier 2 and Supplier 2 made the payment. |

| Purpose |

To recover payment made on behalf of Buyer. |

To ensure compensation for incurred expenses. |

| eInvoice Classification Code |

Classification Code 006 - Disbursement. |

Classification Code 027 - Reimbursement. |

Treezsoft Solution:

- Assign Classification Code 027 - Reimbursement to items/accounts in the Treezsoft e-invoice system.

- Assign Classification Code 006 - Disbursement to items/accounts in the Treezsoft e-invoice system.

- Pre-configure above classification code at the item level to ensure accurate categorization and seamless recovery of payments.

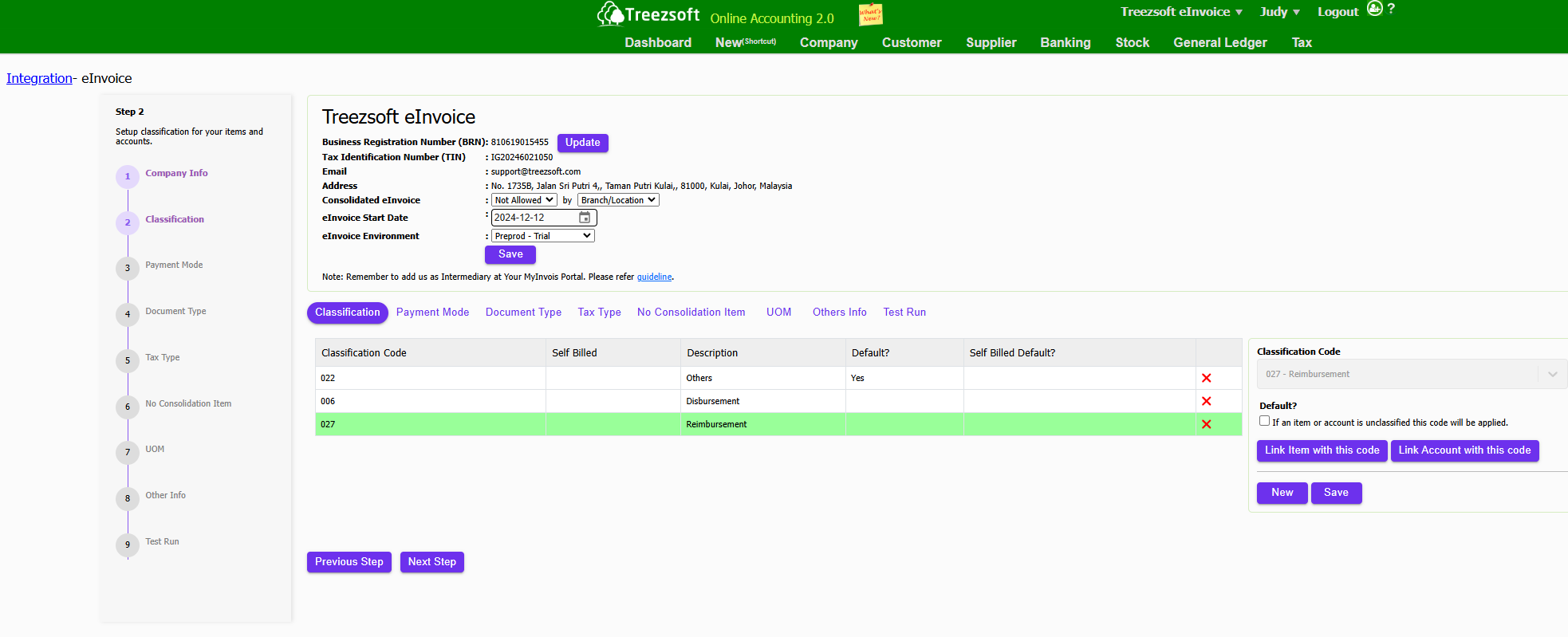

How to Identify and Assign Your Item/Account as Disbursement and Reimbursement in Treezsoft

Treezsoft’s e-invoice system provides a robust solution for handling disbursement and reimbursement scenarios by leveraging classification codes. Here's how you can configure and manage these transactions:

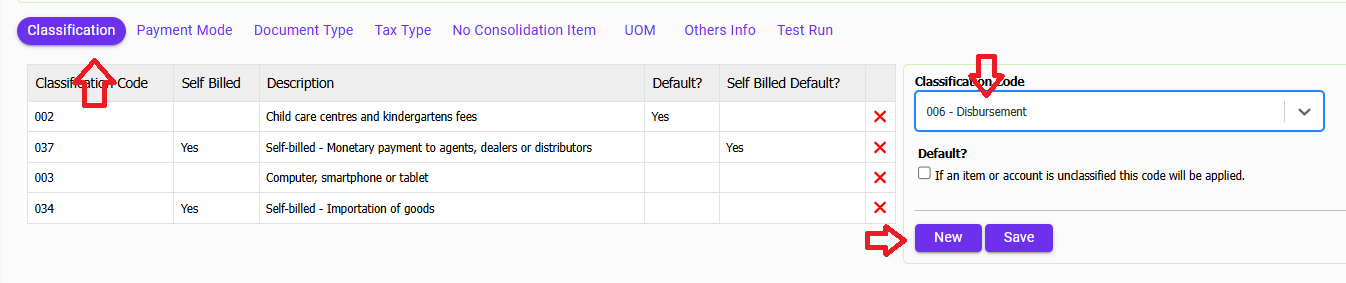

Assigning Classification Codes:

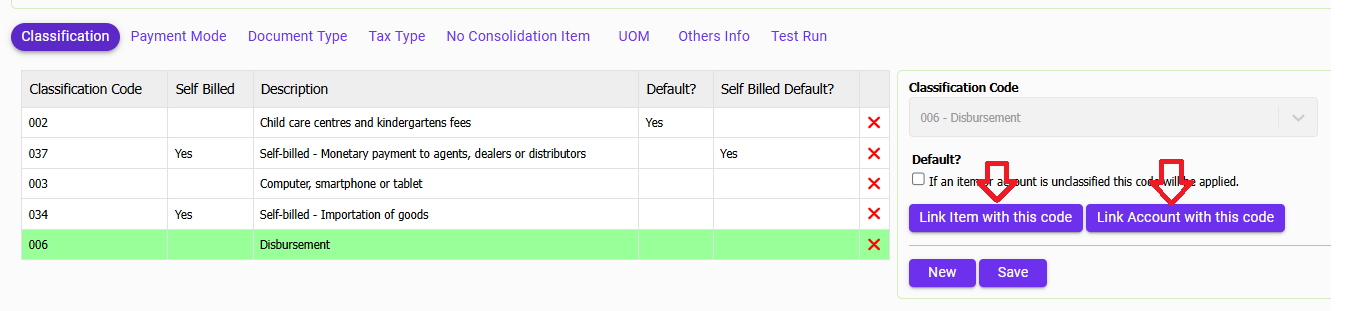

- Navigate to the menu Company > Integration, then configure eInvoice.

- Go to Classification tab, click on "New" button and select the code.

- For items or accounts involving disbursement, select 006 - Disbursement as the classification code.

- For items or accounts involving reimbursement, select 027 - Reimbursement as the classification code.

- Then, save the classification code and proceed to assign either Item or Account under the classification code.

Note 1: Pre-configuring at Item Level:

- Pre-configure classification codes at the item level to automatically apply the correct classification during invoice generation.

- This ensures consistency and reduces manual errors.

Note 2: Setting Defaults:

- You can set a default classification code to automatically apply if an item or account is unclassified.

- This minimizes oversight and ensures compliance with tax regulations.

How to Record Disbursement and Reimbursement Transaction in Treezsoft After above Configuration

- You can include disbursement or reimbursement items as per usual in your invoice to the client.

- You may also issue eInvoice as per usual as long you have done the classification code correctly for the disbursement or reimbursement items.

Benefits of Using Treezsoft for Disbursement and Reimbursement

- Automated Classification: Reduces manual effort and errors by automatically applying the correct classification codes.

- Regulatory Compliance: Ensures alignment with tax regulations by categorizing transactions accurately.

- Streamlined Processes: Simplifies the process of tracking payments and recovering funds, enhancing operational efficiency.

- Customizable Configurations: Offers flexibility to pre-configure codes at the item level for seamless integration into your financial workflow.

Proof of Payment Management:

- Ensure that proof of payment is attached to e-invoices where disbursement or reimbursement applies.

- This documentation supports transparency and facilitates smooth financial audits.

Conclusion

Disbursement and reimbursement are critical components of financial management in e-invoicing systems. By leveraging Treezsoft’s e-invoice classification codes (006 for Disbursement and 027 for Reimbursement), organizations can ensure accurate financial reporting and compliance. Pre-configuring these codes at the item level in Treezsoft’s system further simplifies the process, reducing manual effort and ensuring operational efficiency.

Treezsoft: Your Trusted Partner in E-Invoice Implementation

At Treezsoft, we understand the challenges of transitioning to e-invoicing. As a leader in cloud accounting and e-invoice solutions, we are here to guide you every step of the way:

- Comprehensive Implementation Support: From setup to full integration.

- Customized Solutions: Tailored to your unique business needs.

- Expert Consultation: Backed by our team of top e-invoice professionals.

Why wait until the deadline looms? Take action now and embrace the future of invoicing with confidence.

Don’t Be Left Behind

The move toward e-invoicing is not just about compliance—it’s about future-proofing your business. Start early, stay ahead, and ensure your business thrives in a digital-first economy.

Learn more about how Treezsoft can help you implement e-invoicing effortlessly. Contact us today at +60127875077!

For detailed information on Malaysia's e-invoicing guidelines, refer to the official document here.

Join the Future of Accounting Today

Don't let your business fall behind. Embrace the future of accounting with TreezSoft. Sign up today and be among the first to experience the efficiency and convenience of our e-invoice feature. With TreezSoft Cloud Accounting, you're not just keeping up with the times; you're setting the pace.

TreezSoft is a cloud accounting software for Small and Medium-sized Enterprises (SMEs). You can access your financial information anytime, anywhere and we use automated processes and integration to promote efficiency in your accounting process and financial health management. You can also create unlimited users for FREE for your account in TreezSoft.

Visit TreezSoft at https://www.treezsoft.com/ to sign up for a 30 days trial account with us!

Follow our Facebook Page for more updates: https://www.facebook.com/TreezSoft

You can also email us at [email protected] for more inquiries