Magic Explained - The Balance Sheet

The magic in managing your company's financial health lies with an up-to-date balance sheet.

The balance sheet is an important financial statement used by business owners and accountants to identify their company's financial position. It will show the amount of debt you owe (liabilities), how much your business is worth (shareholders' equity) and how much cash flow you have (assets). With these information, you will be able to identify potential pitfalls in your business' finances.

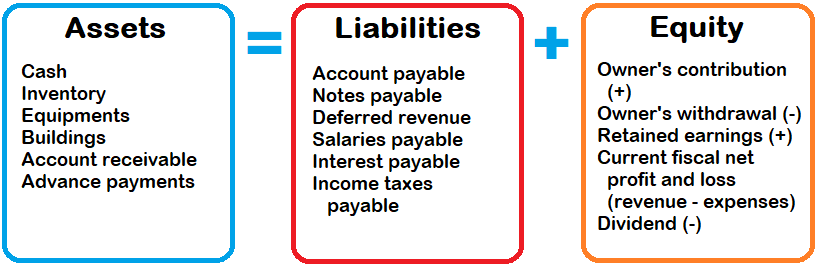

The balance sheet is balanced out using the formula below:

Assets = Liabilities + Shareholders' Equity

or,

Shareholders' Equity = Assets - Liabilities

It must be balanced at all time.

The magic of balancing the "sheet"

The reason why the balance sheet is and should be balanced at all time is because of the relationship between all three components in the formula. When your liabilities increased, your assets or cash in hand will increase as well. When your shareholders' equity increased, your company assets will also increase.

For example, when you borrow a sum of money from the bank, your liabilities increase due to increase in bank loan amount. As you loan the money out from the bank, the amount of money you have will increase. When your business earned a profit it will be recorded as retained earnings under the shareholders' equity. Similarly, your cash in hand will increase as well. In such, the balance sheet will and should always be balanced at all time.

Figure shows examples the accounts under assets, liabilities and equity.

Managing your account using the "magic".

Now, you know the magic of balancing up your account using the balance sheet. But how does the magic applies to managing your business' financial health?

As previously stated, the 3 components that are included in the balancing sheet illustrates different information in your business' finance. These information only provides information of that particular period. You can use these information to generate a number of ratios to compare balance sheets accross a period of time or with other company of the same sector (your competitors).

In such a way, you will be able to know whether your company's profit is growing, is your debts reduced compared to previous years or your business' ability to pay for short-term expenses and liabilities (known as company's liquidity) or how well your company is managing its assets (known as financial efficiency). You can also know whether your company's profit is competitive compared to other company in the same sector, or where you stand in that particular instudry.

I don't like magic, can I just ignore it?

Some may be wondering, "Balance sheet sounds complicated, why can't I just ditch it?"

Well, the truth is, balance sheet provides imensely valuable information for business owners to know their company's future financial direction as no business owner would like to make their business a failure. Everyone wants to succeed in one way or another. You can only succeed with wisdom in managing your company's finance. Therefore, ditching it is not a choice.

Besides, others who may be interested in a company's balance sheet are company management, potential investors, competitors, suppliers and government agencies.

In short, balance sheet illustrates your business' net worth. It gives you a snapshot of a company's financial position at a specific period.

Magic continues with TreezSoft

We bring great news!

While ditching the balance sheet is not a choice, you can try to find peace with it instead. You can find peace with balance sheet through TreezSoft cloud accounting. With TreezSoft, you no longer need to go through the hassle in combining the spreadsheet or entering the double entry needed. TreezSoft cloud accounting system will update the respective general ledger automatically when you enter any record to your account anytime. Your account entries will be automatically balanced up by our automated double entry system. You can then generate your balance sheet with just a few clicks. You just have to keep your account in TreezSoft up to date!

TreezSoft is a cloud accounting software, it allows you to access your financial information anytime, anywhere. It also allows you to create unlimited users for FREE for your account in TreezSoft.

Click on the button below to sign up for a 30 days trial account with us!

You can also email us at [email protected] for more enquiries.