What is unrealized gain/loss?

Profits or losses that have risen on paper but the transactions that are yet to be executed are referred to as unrealized gains and losses.

(You can read more about realized and unrealized gain/loss through this link what is realized and unrealized gain/loss.)

It is commonly used in transactions related to foreign currencies. When the exchange rate is constantly changing, any invoices you have in that currency will have a different value.

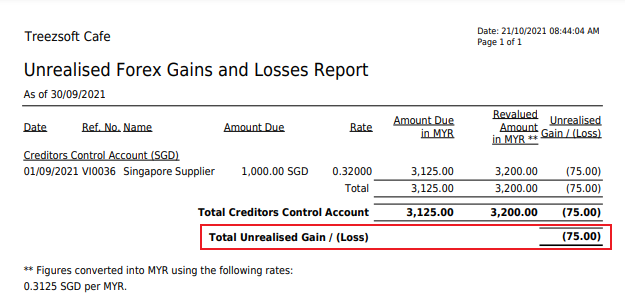

For example, a supplier has invoiced you for sales worth 1,000 SGD and it is worth RM3,125.00 at an exchange rate of RM1.00 = 0.32 SGD. If the exchange rate changes to become RM1 = 0.3125 SGD, the 1,000 SGD invoice is now only worth RM3,200.00 when converted to Malaysia Ringgit. Since payment has not been made, therefore, you have on paper made a loss of RM75. This is termed an unrealized loss.

Step by step guide to record unrealized gains/loss

In case when you want to record your business' unrealized gain and loss, we'll guide you on how to record unrealized gain and loss in this blog and foreign exchange will be used as an example.

Step 1: Check for any unrealized gain and loss given the selected period of time.

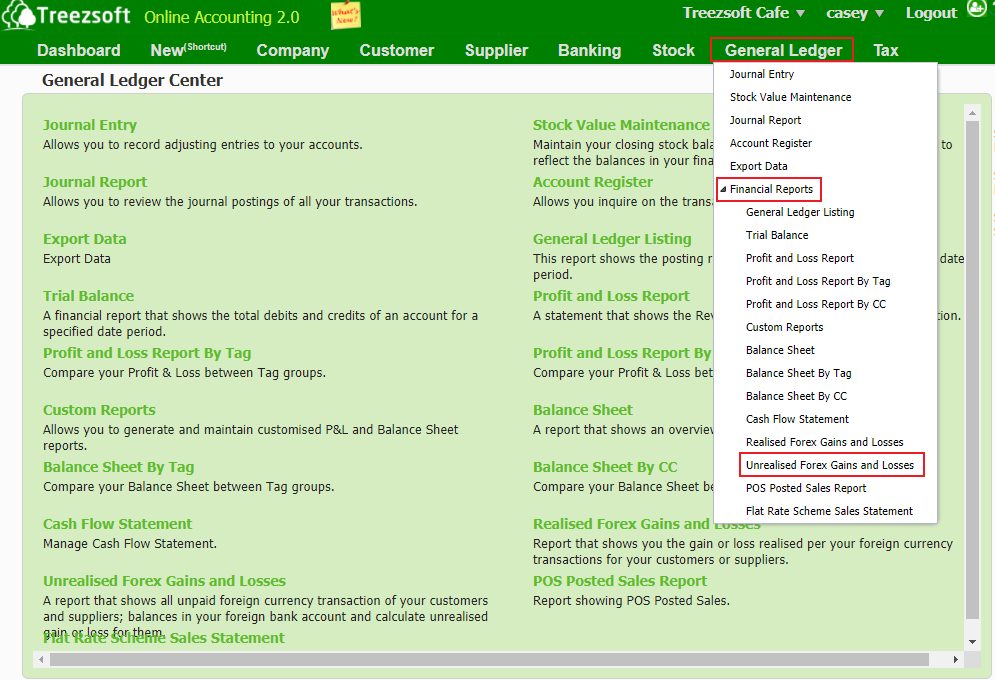

You may view your Unrealized Gains/Loss Report in the TreezSoft accounting system by navigating through General Ledger > Financial Reports > Unrealised Forex Gains and Losses.

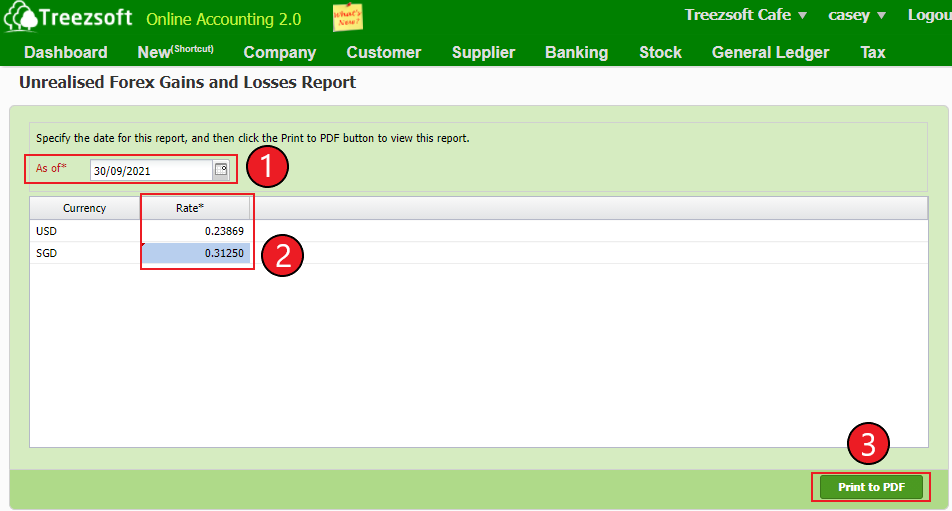

Below screen shows the Unrealised Forex Gains and Losses Report:

You may search by:

- Select the Date of the report you want to generate.

- Key in the latest currency rates in that period to calculate the unrealized gain and loss.

- Click "Print to PDF".

Here's the screenshot of the pdf. It will show you the unrealized gain and loss that you've made within the selected period.

Step 2: Raise journal entry to record the unrealized gain and loss

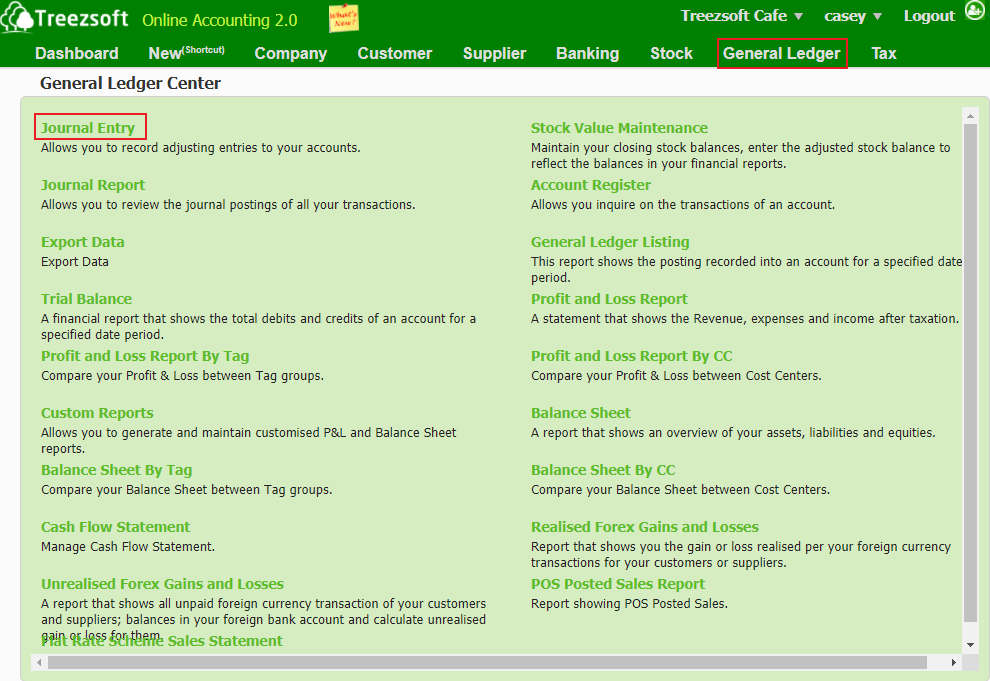

After checking the unrealized forex gains/losses, all you have to do is to raise a Journal Entry to record the unrealized gain/loss.

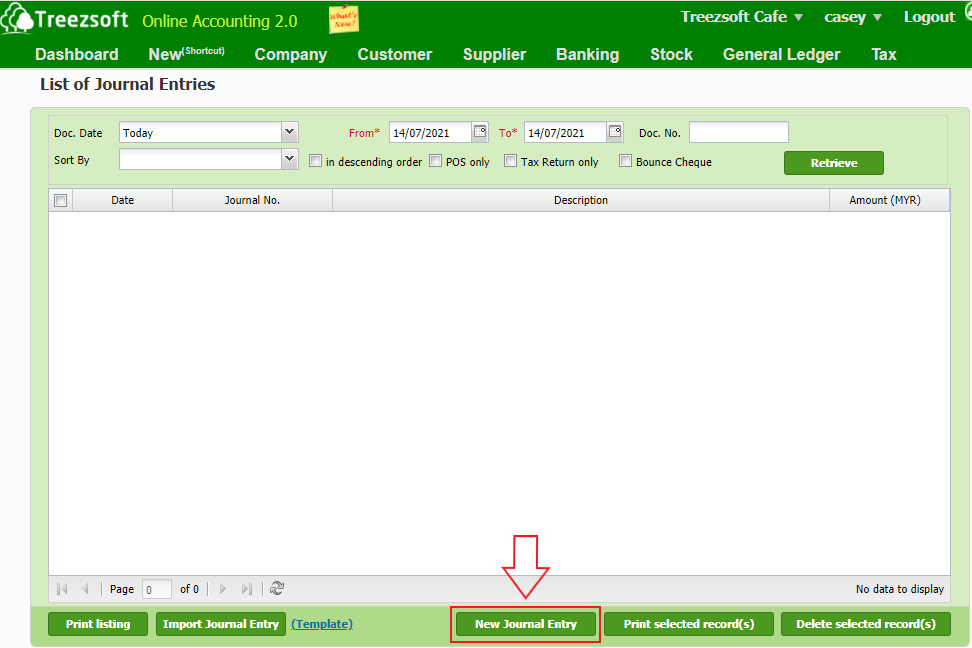

Step1: Go to General Ledger > Journal Entry.

Step2: Click on the "New Journal Entry" button at the bottom.

Step 3: Record Unrealized Gains/Loss.

a. For Unrealized Foreign Exchange Loss:

A. Select the Date for the Journal Entry.

B. Select the Currency used.

C. Write down your Description for the Journal Entry.

D. Record the entry for Unrealized Loss

Dedit unrealized forex loss account.

Credit the account payable.

E. Enter the amount of Unrealized Forex Loss.

F. Click on Save to record the transaction.

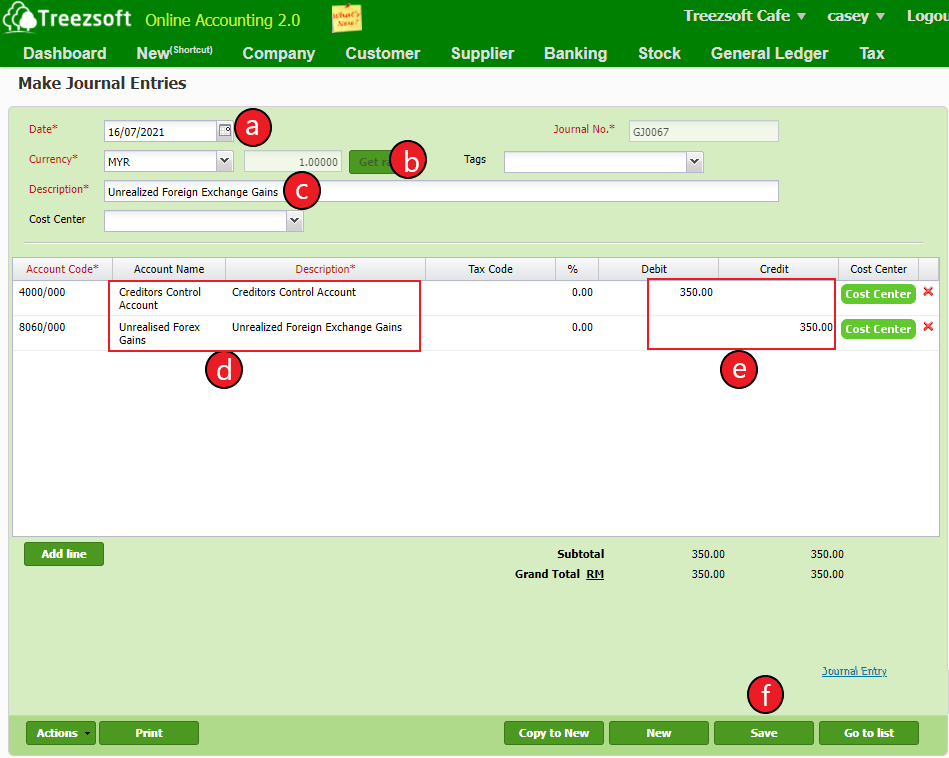

b. For Unrealized Foreign Exchange Gain:

A. Select the Date for the Journal Entry.

B. Select the Currency used.

C. Write down your Description for the Journal Entry.

D. Record the entry for Unrealized Gains

Debit the account payable.

Credit to the unrealized forex gains account.

E. Enter the amount of Unrealized Forex Gains.

F. Click on Save to record the transaction.

By following the steps, you will be able to record your unrealized gains and losses easily in Treezsoft Cloud Accounting Software!

You can read realized gain/loss in the TreezSoft blog through this

link https://blog.treezsoft.com/blog/user/slogin?u=/blog/blog/detail/469

You can read more on related topics in the TreezSoft blog:

TreezSoft is a cloud accounting software for businesses - regardless of what kind of business you are. It allows you to access your financial information anytime, anywhere. It also allows you to have unlimited users for FREE for your account in TreezSoft. We would like to be long-term partners of your business - to reduce our clients' time spent on accounting mainly by using our automated processes and integration to help increase their company efficiency at minimum costs and expand your business together with Treezsoft.

Visit TreezSoft at http://www.treezsoft.com/ to sign up for a 30 days trial account with us now!

You can also email us at [email protected] for more inquiries.