The balance sheet is a type of financial statement that displays assets, liabilities, and shareholders' equities at a point in time. It provides a snapshot of a company's financial condition and goes by the formula: Assets = Liabilities + Equities.

Both sides of the equation have to be balanced, giving it the name "Balance Sheet". You can refer to our previous articles to know more about how the balance sheet works for your company's financial position.

Companies owners, investors, and analysts will study a company's balance sheet to check if the company's financial position is healthy and sustainable. With information on the balance sheet, company owners can also make appropriate changes to make sure the company can continue growing.

Hence, knowing whether a company's balance sheet is healthy is important for a company owner.

There are various ways you can examine a company's health using the balance sheet, here are 4 telltale signs of a healthy balance sheet. You can use these 4 signs to do a quick check on a company's financial health.

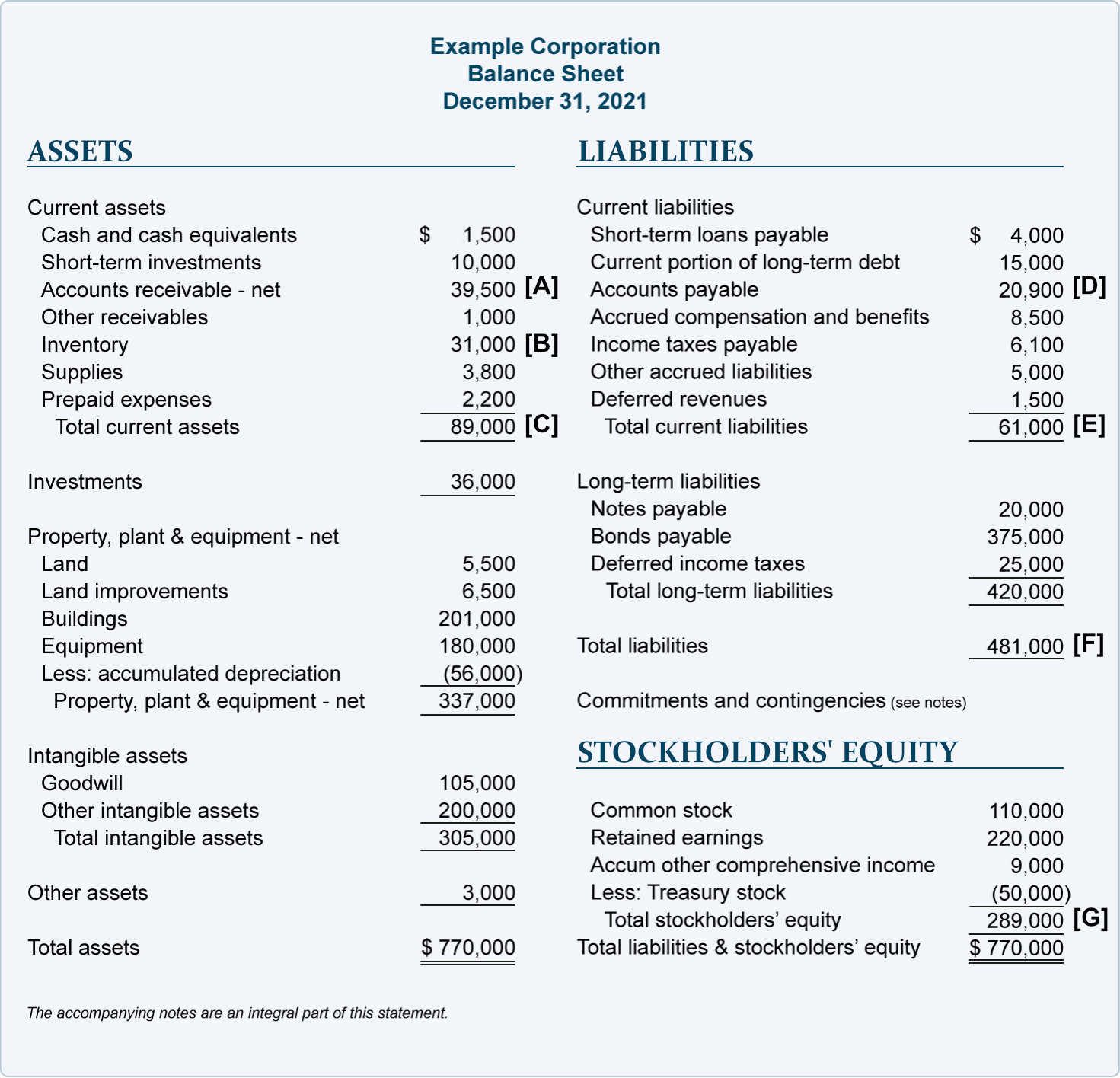

Here is an example of the "EXAMPLE COMPANY'S" balance sheet that will be used as a reference in the rest of this article.

1. Quick Ratio > 1.5

Quick Ratio is one of the many measurements to measure a company's financial health. The Quick Ratio measures the ability of a company to pay its short-term obligations and debts.

Quick Ratio = (Current Assets - Inventories) / Current Liabilities

The formula of a Quick Ratio is a more conservative measure compared to the current ratio which does not minus out inventories. Normally, a company with a quick ratio < 1.0 is considered to have liquidity issues and companies with a quick ratio of 1.5 and above are considered healthy.

Taken from the balance sheet example above, the quick ratio for the Example Corporation can be calculated as below:

Quick Ratio = (Current Assets - Inventories) / Current Liabilities

= (C - B) / E

= (89,000 - 31,000) / 61,000

= 0.95

A quick ratio of 0.95 suggests that the company may need to reduce some of its short-term liabilities, find ways to increase current assets, or decrease its inventory held on hand.

2. Debt to Equity Ratio < 2.0

Another measurement to measure a company's financial health is the Debt to Equity Ratio (D/E ratio). This ratio divides a company's liabilities against its stockholders' equity to measure how much the leverage a company has taken on based on the capital they have. A company with a D/E ratio lower than 2.0 is considered healthy.

D/E Ratio = Total Liabilities / Stockholders' Equity

Continuing from the example above, the D/E ratio of Example Corporation can be calculated as below:

D/E Ratio = Total Liabilities / Stockholders' Equity

= F / G

= 481,000 / 289,000

= 1.66

A D/E ratio of 1.66 suggests that the company leverage is still at a healthy level.

3. Account Receivables > Account Payables

Another sign of a company's financial health is that there should be more debtors than creditors. In layman's terms, debtors refer to the parties that owe you money and creditors refer to the parties that you owe money to.

From the example above, account receivables refer to amount A, and account payables are amount D. The amount in A ($ 39,500) is greater than the amount in D ($ 20,900) in the above example, suggesting that the company has a higher receivable amount than the amount to be paid. Hence. this suggests that the company's cash flow is at a healthy level.

** Things to note: When looking at the receivables and payables account it is also important to take note of the terms of payment and ageing periods of the account. This will let you know how fast is your money coming in and going out. If the payment terms and ageing periods are stretched, it could cause a cash flow issue for the company.

4. Improving trends

The 4th sign of a healthy company is a company that has the potential to grow in the future. One way to look at the potential growth of a company is the trend of ratios calculated when compared to previous years. To identify the trends, you'll calculate the ratios for the current year and compare them with the same period of the previous years. The ratios should show a trend of improving from previous years to the current year. This will suggest that the company is on the right track and is sustainable.

With these 4 telltale signs of a healthy balance sheet, one can have a quick snapshot of a company's financial health. However, it is also important for you to learn and understand the company's finances in detail to better understand a company before making any financial decision on a company.

You can continue reading on reporting in TreezSoft blogs through these links:

TreezSoft is a cloud accounting software for Small and Medium-sized Enterprises (SMEs). It allows you to access your financial information anytime, anywhere. It also allows you to have unlimited users for FREE for your account in TreezSoft. Our aim is to help reduce our clients' time spent on accounting mainly by using our automated processes and integration to help increase their company efficiency at a minimum cost. SMEs can use TreezSoft to keep track of their expenses, accounts, daily operation e.g. Point of Sales (namely QPOS) system and etc.

Visit TreezSoft at http://www.treezsoft.com/ to sign up for a 30 days trial account with us!

You can also email us at [email protected] for more inquiries.