From the previous post, you will be able to identify whether you are eligible for sales tax exemption. This post will focus on how to apply for such exemption.

As previously mentioned, there are 3 types of personel that is exempted from Sales Tax. If you fall under schedule A to C of the exempted personel group, then you may proceed to apply for tax exemption.

There are 2 main ways to apply for tax exemption: Online or manual submission. We will outline how each schedule types may apply for exemption.

Schedule A (class of person)

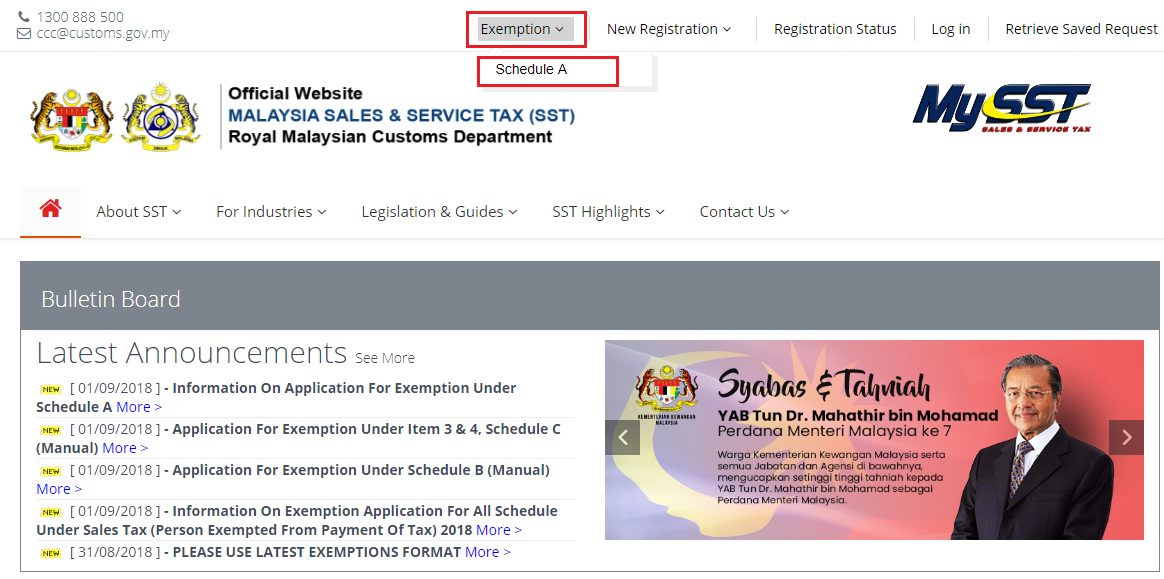

Online application. You can apply for an exemption through MySST official website. Click on the Exemption tab. Then, Schedule A (shown in the screenshot below). You will be brought to a new screen. Fill in all information required.

Schedule B (manufacturer of non-taxable item)

For manufacturer under this schedule, you will need to submit your application manually, by emailing to the custom's exemption department. This process is temporary until further notice from custom office.

Custom office also listed a detailed guide on Application For Exemption under Schedule B (Manual). You can follow the steps listed in the document.

Schedule C (manufacturer of taxable item)

For manufacturer under Schedule C, you will be futher classified according to the type of taxable item you are manufacturing.

a. Item 1 & 2

Manufacturer of taxable item 1 and 2 can apply online for exemption on SST payment through MySST website. The custom office had provided a step by step guidance on how to apply.

Before initiating the application online, you will need to prepare an excel file that includes details of your purchases. You can download the latest excel files for your respective items through this page.

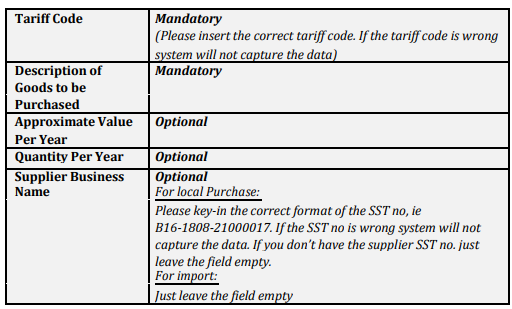

The guide to fill in the information in the excel file is as below:

b. Item 3 & 4

Application for exemption for manufacturer of taxable item 3 and 4 can apply through MySST online portal. Nevertheless, online application is only limited to one major appointment of person on behalf. The subsequent appointment of person on behalf have to be done manually for the time being, until further notice. A detailed on manual application for exemption for Item 3 and 4 can be found from MySST portal.

c. Item 5

Manufacturer of item 5 can submit their application through MySST online portal as well. But this application is only limited to one applications of sub-contractor. Subsequent application for sub-contractor has to be done manually. A detailed on manual application for exemption for Item 5 can be found from MySST portal.

You can visit the links below to read more on SST related topics in TreezSoft:

TreezSoft is a cloud accounting software for Small and Medium-sized Enterprises (SMEs). It allows you to access your financial information anytime, anywhere. It also allows you to have unlimited users for FREE for your account in TreezSoft. Our aim is to help reduce our clients' time spent on accounting mainly by using our automated processes and integration to help increase their company effeciency at a minimum costs. SMEs can use TreezSoft to keep track their expenses, accounts, daily operation e.g. Point of Sales (namely QPOS) system and etc.

Visit TreezSoft at http://www.treezsoft.com/ to sign up for a 30 days trial account with us!

You can also email us at [email protected] for more enquiries.