From 1st September 2018 onwards, the main tax system in Malaysia will change from Goods and Service Tax (GST) to the Sales and Service Tax (SST). All businesses in Malaysia are required to update their tax system accordingly.

The first SST taxable period and first return and payment period differs according to whether your Financial Year End Month (FYE month) is on odd or even month.

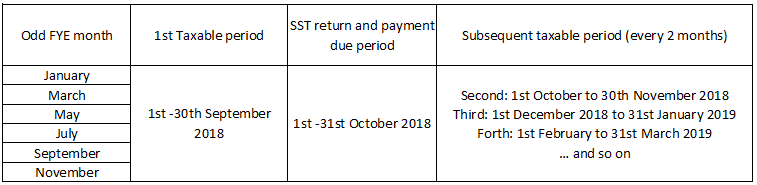

For odd FYE months

If your FYE months fall on a odd months (e.g. January, March, May, etc), your 1st taxable period is one month, which is 1st September 2018 to 30th September 2018. Your 2nd and subsequent taxable period will then follow the normal SST return period (2 months(, from 1st October 2018 to 30th November 2018 amd so on.

Table 1: Taxable period explained for company with odd FYE months.

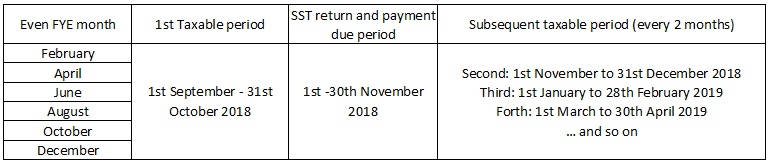

For even FYE months

If your FYE months all on an even month (e.g. February, April, June, etc), your 1st taxable period is 2 months, which is 1st September 2018 to 31st October 2018. Your 2nd and subsequent taxable period will continue to follow the normal SST return period (2 months), from 1st November 2018 to 31st December 2018 and so on.

Table 2: Taxable period explained for company with even FYE months.

No matter which is your FYE month, when submit your SST tax return form (SST-02), you will need to submit it electronically via [email protected] and make tax payments in the same portal through FPX facility from 17 chosen banks. Alternatively, you can make payments by cheques or bank drafts to Ketua Pengarah Kastam Malaysia and post it to the Customs Processing Center (CPC) together with the printout out of respective Tax returns document submitted electronically.

You can visit the links below to read more on SST related topics in TreezSoft:

TreezSoft is a cloud accounting software for Small and Medium-sized Enterprises (SMEs). It allows you to access your financial information anytime, anywhere. It also allows you to have unlimited users for FREE for your account in TreezSoft. Our aim is to help reduce our clients' time spent on accounting mainly by using our automated processes and integration to help increase their company effeciency at a minimum costs. SMEs can use TreezSoft to keep track their expenses, accounts, daily operation e.g. Point of Sales (namely QPOS) system and etc.

Visit TreezSoft at http://www.treezsoft.com/ to sign up for a 30 days trial account with us!

You can also email us at [email protected] for more enquiries.