Starting from 1st September 2018, the Goods and Service Tax (GST) in Malaysia is replaced by the Sales and Service Tax (SST). SST is made up by 2 separate tax act – Sales Tax Act and Service Tax Act. The sales tax is only applied on manufacturer of taxable goods and service tax is applied on service provider that provides taxable services. All manufacturer or service provider who reached the threshold set according to the type of taxable goods and service will be legally required to register for SST.

However, there are certain areas in Malaysia that are designated as tax-free zone. Meaning, they are excluded from SST charges. SA includes Labuan, Langkawi and Tioman. These areas are referred as Special Area (SA) and we will discuss further on how the SST works in these areas.

Below are explanation for terms used in this article:

- Free Zone (FZ)

- Principal Customs Areas (PCA)

- Licensed Warehouse (LW)

- Licensed Manufacturing Warehouse (LMW)

The determination of whether goods will be taxed in transaction involving SA depends on the movement of goods.

This article will focus on importation of goods to SA. There are 3 main situation: a) goods purchased directly from the seller, b) goods purchased directly from seller through a trader and c) goods purchased through a trader who import goods from a seller.

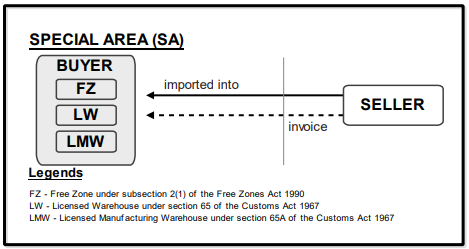

a) Goods purchased directly from the seller.

There will be no sales tax charges on taxable goods purchased by buyers in SA.

Figure 1: Taxable goods directly from seller directly imported into SA

The buyer should declare the goods purchased in import declaration form accordingly. If the seller is a SST registered manufacturer, the manufacturer will need to declare export declaration form or related documents according to the custom’s requirement.

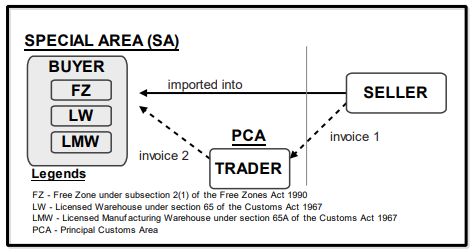

b) Goods purchased directly from seller through a trader

There will also be no sales tax charges on taxable goods purchased through traders, when the buyers in SA import the goods directly from the seller (movement of goods illustrated in Figure 2).

Figure 2: Taxable goods directly from seller directly imported into SA through a trader

The buyer will need to declare the goods imported in the import declaration form. However, if the manufacturer is SST registered, the manufacturer will need to declare the export of goods in declaration form instead.

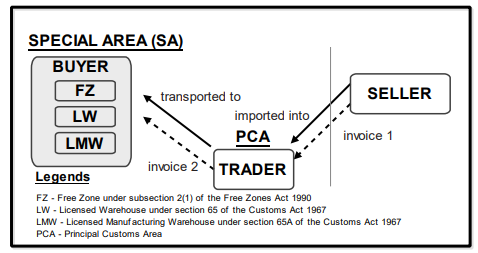

c) Goods purchased through a trader who import goods from a seller

Figure 3 shows a buyer purchase taxable goods through a trader and the goods were imported by the trader into PCA which were subsequently transported to the buyer in SA. Sales tax should be charged on the goods imported to PCA by the trader, while no sales tax should be charged on goods transported into SA.

Figure 3: Taxable goods imported to PCA (Trader) and subsequently transported to SA

When importing goods, the trader will need to declare the importation of goods in Customs Form No. 1 (K1) and import declaration form. The trader will also need to declare the transportation of goods to SA in the export declaration form or related documents according to the guideline given from Malaysia custom department.

For detailed information on the custom's guideline on SA, please refer to the official document from custom.

Our next article will be focused on exportation of goods from SA. Stay tuned!

Here are some related topics in TreezSoft blog for your further readings:

TreezSoft is a cloud accounting software for Small and Medium-sized Enterprises (SMEs). It allows you to access your financial information anytime, anywhere. It also allows you to have unlimited users for FREE for your account in TreezSoft. Our aim is to help reduce our clients' time spent on accounting mainly by using our automated processes and integration to help increase their company effeciency at a minimum costs. SMEs can use TreezSoft to keep track their expenses, accounts, daily operation e.g. Point of Sales (namely QPOS) system and etc.

Visit TreezSoft at http://www.treezsoft.com/ to sign up for a 30 days trial account with us!

You can also email us at [email protected] for more enquiries.