Deposit refers to a sum of money being paid as a pledge for a contract. It can also refer to the advance payment on a purchase of products whereby, the balance will be paid later.

GST relating to deposit and advance payment in TreezSoft

When you've received deposits or advanced payment from your customer, you will have to record them in your TreezSoft cloud accounting software account. Whenever the deposit forms part payment of the total consideration payable by the recipient, GST will be chargeable at the time of payment of the deposit. Nevertheless, if the deposit are used as security and will be fully refunded upon completion of services, no GST will be chargeable.

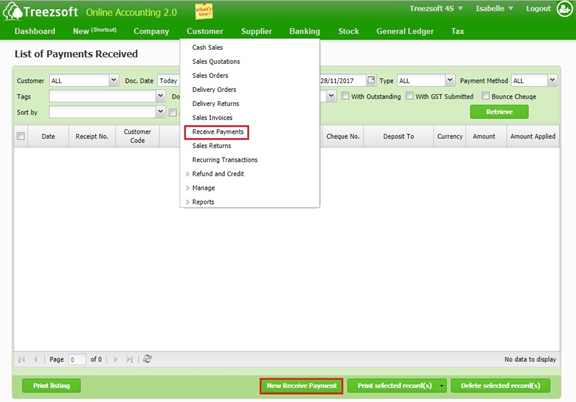

Step 1: To create receive payments, navigate through: Customer > Receive Payments.

Click on the “New Receive Payment” button at the bottom right corner.

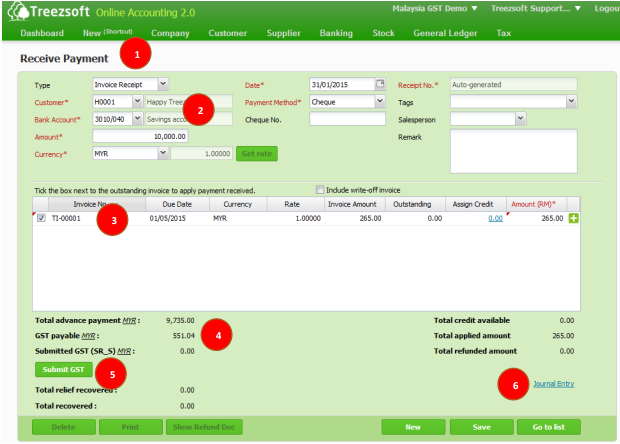

Step 2: Enter the details and tick the box next to the outstanding invoice to apply payment received.

1. Go to Receive Payment (under Customer module), and click New Receive Payment.

2. Select Invoice Receipt, Customer, and fill in Amount received.

3. If have invoice to be paid, just tick on it.

4. Any unapplied received amount would be considered as deposit or advance payment. System

will auto calculate GST payable MYR based on Total advance payment MYR.

5. Click Submit GST to declare GST for advance payment.

6. Click Journal Entry hyperlink to verify inserted double entry.

Below are the explanation for some terms used:

GST payable: Any unapplied received amount would be considered as deposit or advance payment. System will auto calculate GST payable based on total advance payment.

Total advance payment: Total advance payment that received in this receive payment only.

Submitted GST: GST that has been submitted and declared.

Total credit available: Amount received that have not offset with outstanding invoice in another receive payment.

Total applied amount: Amount applied to offset outstanding invoice in this receive payment.

Total refunded amount: Amount refunded to customer when there is remaining amount after offset all the outstanding invoice.

Total relief recovered: Amount relief to be recovered for GST if any applied invoice has issued bad debt relief previously.

Please note that our TreezSoft cloud accounting system will auto-prompt you on whichever advance payment that is due to submit in GST-03.

You do not need to submit the advance payments' GST if the date of submission is not due yet.

You can visit these links to read more about GST modules in TreezSoft:

TreezSoft is a cloud accounting software for Small and Medium-sized Enterprises (SMEs). It allows you to access your financial information anytime, anywhere. It also allows you to have unlimited users for FREE for your account in TreezSoft. Our aim is to help reduce our clients' time spent on accounting mainly by using our automated processes and integration to help increase their company effeciency at a minimum costs. SMEs can use TreezSoft to keep track their expenses, accounts, daily operation e.g. Point of Sales (namely QPOS) system and etc.

Visit TreezSoft at http://www.treezsoft.com/ to sign up for a 30 days trial account with us!

You can also email us at [email protected] for more enquiries